Dhruv Moondra

8 August 2025

When you think about the poorest countries in the world, what comes to your mind? You would probably think of countries like Afghanistan, the DRC or Venezuela. Yet these are in fact among the countries that hold the most precious natural resources such as gold, diamonds, cobalt or lithium. What makes countries that are so rich, so poor and why is it that countries like Singapore or South Korea that have no natural resources are among the richest in the world?

The answer to all these questions is a phenomenon called the ‘resource curse’ also known as the paradox of plenty. According to investopedia.com, ‘the resource curse is a paradoxical situation in which countries with an abundance of non-renewable natural resources experience stagnant economic growth or even economic contraction’. There are various causes for this occurance, but the most important reason is that countries blessed with the resource concentrate most of their factors of production towards a single industry(i.e the natural resource) such as oil production or mining, making the economy overly dependent and thus vulnerable to the fluctuations in global demand and supply of the commodity.

The case of Venezuela:

Did you know that Venezuela was once a developed country with a GDP per capita among the top 20 highest in the world in 1970? However today it is now the second poorest nation in Latin America, ranking amongst the poorest countries in the world. So what happened?

Before the discovery of oil in the early 20th century, Venezuela was a poor agrarian economy, primarily focused on the export of coffee, cocoa and leather. However, this quickly changed following the beginning of oil production in the 1920s. Oil exports rose quickly from worth being just 2% of total exports to over 90% and Venezuela became the second largest oil producer in the world.

This jackpot sowed the seed for both economic prosperity and decline as we will see later.

As oil exports continued to grow, the rise in net exports caused the value of the bolivar, their national currency, to significantly appreciate. This made the export of other products from the primary and secondary sector highly uncompetitive due to the high currency price. As a result, while the oil industry prospered, it did so at the expense of the rest of the economy as the other industries disappeared.

The result of this over-specialisation was seen in a series of connected events including the restructuring of the economy and of political institutions that eventually led to Venezuela’s aftermath and economic crisis.

Firstly, Venezuela nationalised the oil industry, making it run by a single state run oil company called PDVSA in the name of safeguarding their most prized resource for their citizens. Not only did this make the industry more inefficient, due to a lack of competition and profit incentives but it also made the economy heavily dependent on the state. This change fostered the beginning of widespread corruption since everything was dependent on the state. On top of that, during the same period, the state underwent a massive expansion as the government took over massive industrial projects, expanded welfare programs, and invested in infrastructure, as a bid to industrialise and diversify the economy. However, many of these ventures failed as the government was highly inefficient and the ridiculously high exchange rates meant that imports were very cheap while exports would be too expensive to compete. This coupled with inefficiency made these industries unprofitable.

The worst part is that with the increasing role of public institutions in Venezuela’s economy, the state became the primary dispenser of wealth, which in turn made control of the state the ultimate prize. The reliance on oil meant the creation of a political culture in which loyalty was rewarded with a share of the oil wealth, rather than a focus on building robust, independent institutions.

Consequently, over time the democratic institutions of the country began to decay and the crash in oil prices during the 1980s caused an economic crisis that provoked public unrest and political instability. In the end, democracy was overthrown by a dictatorship in the Bolivarian revolution that sought to deepen state control and abolish laws that prevented it from consolidating power and control.

The continuous deterioration of governance and institutions allowed corruption to become endemic and the policies aimed at restricting the private sector meant the emigration of many talented professionals and business activity.

Additionally, the economic policies of the Bolivarian government including strict price and currency controls created huge shortages of basic goods like food and medicine,causing widespread extreme poverty.

Furthermore, the 2014 collapse in oil prices triggered an economic and humanitarian catastrophe. The exchange rate collapsed and since the economy relied heavily on imports, it resulted in hyperinflation.

Ultimately, the result of all these disastrous policies, stemming from institutional decay and corruption led to Venezuela losing 80% of its GDP from 2013 to 2023. This case studies shows how Venezuela’s vast oil wealth created heavy dependence on a single resource, making the economy vulnerable to price shocks. The resulting currency appreciation weakened agriculture and industry. Nationalization and state control led to inefficiency and widespread corruption. Political power became tied to controlling oil wealth, weakening institutions and causing instability. Combined with populist policies, this triggered economic collapse, hyperinflation, shortages, and mass emigration. Venezuela’s case shows how resource abundance can become a resource curse because without good governance and diversification, it can lead to severe economic and social crises.

The case of the DRC:

The Democratic Republic of Congo is one of the most resource rich countries in the world, controlling many of the key mineral reserves essential for global supply chains. Although it is estimated to possess around $24 trillion worth of mineral deposits, today it consistently ranks among the top 5 poorest nations globally.

While both Venezuela and the DRC have suffered from the resource curse, the story of the DRC is slightly different. The country’s economic downfall also stems from weak governance, economic mismanagement and corruption, and yet the outcomes have not been the same.

While in Venezuela, people fought for political power over the state and therefore oil production, the DRC fell into civil war.

As in Venezuela, the same pattern can be seen here during the mining boom. From the 1960s onwards, international commodity prices surged, allowing the economy to prosper and by the 1980s, mining exports accounted for 75% of all exports and 25% of fiscal revenue, allowing the economy to grow at the expense of other industries(export competitiveness and cheap imports).

During this time, the Mobuto regime used the increased revenues to consolidate power and enrich elites instead of investing money towards welfare and long-run economic growth. As a result, the state and the economy became increasingly dependent on the mining of coppers and minerals and when commodity prices started declining from the 1980s onwards, it triggered an economic crisis.

At the same time, DRC suffered from sky-rocketing government debt due to rampant corruption and economic mismanagement and the country experienced hyperinflation owing to the rock-bottom exchange rates from the balance of trade and falling exports.

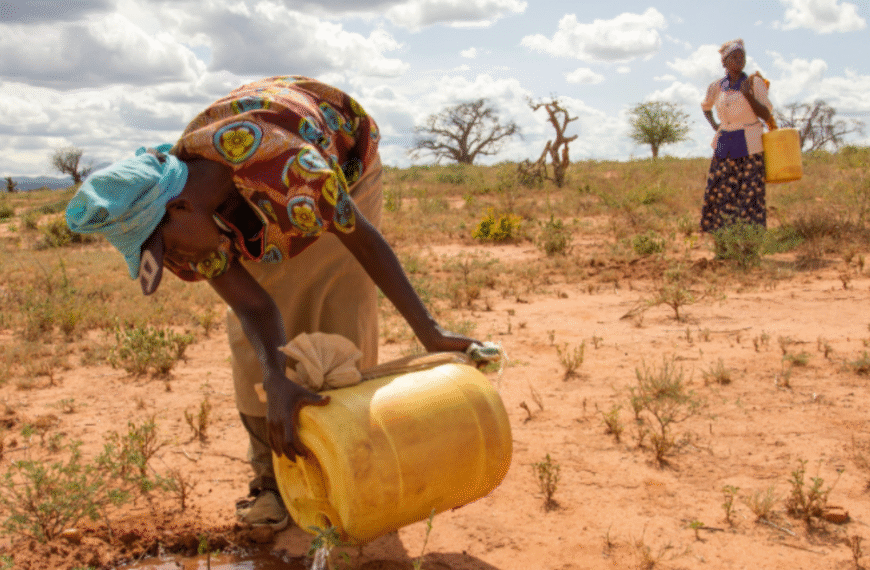

Due to public suffering and frustration, these events led the country to a series of civil wars that further ravaged the country. Several militia groups fought over the mineral-rich regions destroying most of the country’s infrastructure while millions were forced to flee their homes. Without infrastructure and human capital, the functioning of trade, production and investment was impossible and the DRC’s potential output was greatly diminished.

In conclusion, the tragic trajectories of Venezuela and the Democratic Republic of Congo powerfully illustrate that natural resources are not a guarantee of prosperity. If government institutions are weak and economic policies are neglected, natural resources can easily become a curse and lead to ruin.

However it doesn’t always have to be that way.

Norway is a country that was also blessed with immense natural resources but it turned out to be everything these countries are not because of their long-term vision and policies that prevented the country from falling into the trap.

In the 1960s, oil was discovered in Norway but instead of jumping in and extracting the resource as much as they could, Norwegian ministries analysed the mistakes made my countries in the past and how economies became incredibly vulnerable to changes in the international prices of commodities like oil that ultimately led to an economic,social and political crisis. Instead they acknowledged that oil was a non-renewable resource and chose to prolong the benefits of the national resource for future generations while keeping their currency prices in check to allow other industries to thrive.

Therefore, Norway established the sovereign wealth fund in 1983 and implemented a series of strict rules that prevented the oil revenues from affecting the rest of the economy.

This sovereign wealth fund was used to invest surplus revenues from the country’s petroleum sector abroad. By investing in a globally diversified portfolio of equities, bonds, and real estate, the fund ensures that the returns are not tied to the Norwegian economy and protects the country from domestic market bubbles(overheating prices due to increased aggregate demand). Additionally, to ensure that inflation is kept under control and that there is enough oil wealth for future generations, the government is only allowed to use up to 4% of the sovereign fund’s portion to spend in the economy.

Consequently, the Norwegian government isn’t too reliant on oil revenues for income and it allows them to focus on developing other areas of the economy and providing merit goods, thus creating a sustainable, stable economy whose fate isn’t tied to the booms and busts of the oil industry.

Citations:

https://www.perplexity.ai/search/name-poor-countries-who-have-a-CRoZoUtGRheZkmmK8QZuMA

Leave a Reply

You must be logged in to post a comment.